2021 State of the Industry report

While many landscapers recorded a strong year financially, sourcing materials will remain a challenge in 2022

Sourcing materials and labour shortages presented the biggest hurdles for Canadian landscapers in 2021. Looking ahead to next year, both issues are expected to remain predominant challenges for the profession.

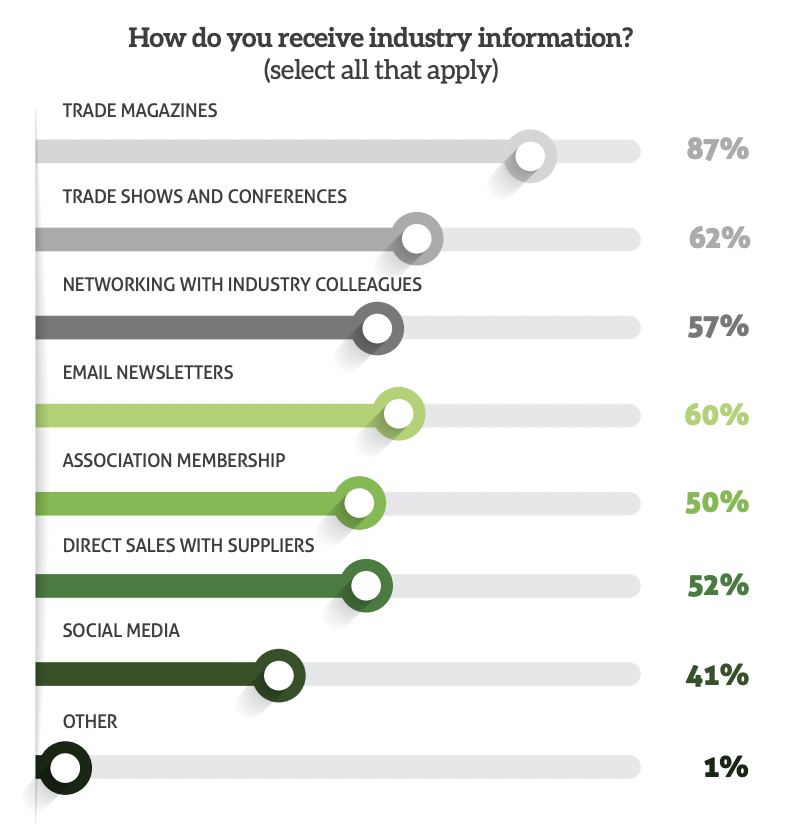

Landscape Trades recently conducted a state of the industry survey in an effort to check the pulse of the trade across Canada.

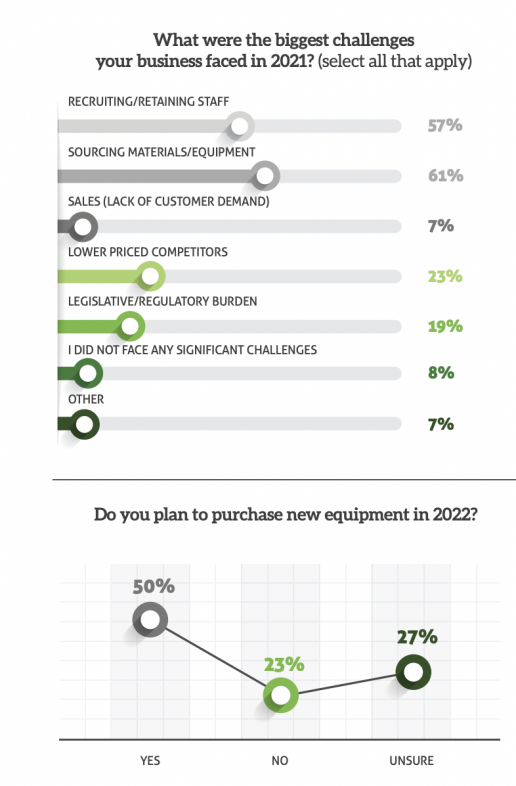

The survey found product and equipment shortages were the most common challenge for landscapers in 2021, with 61.1 per cent of respondents naming material or equipment shortages as a major issue. Recruiting or retaining staff was the second highest challenge, with 57 per cent of respondents noting staffing as a significant concern.

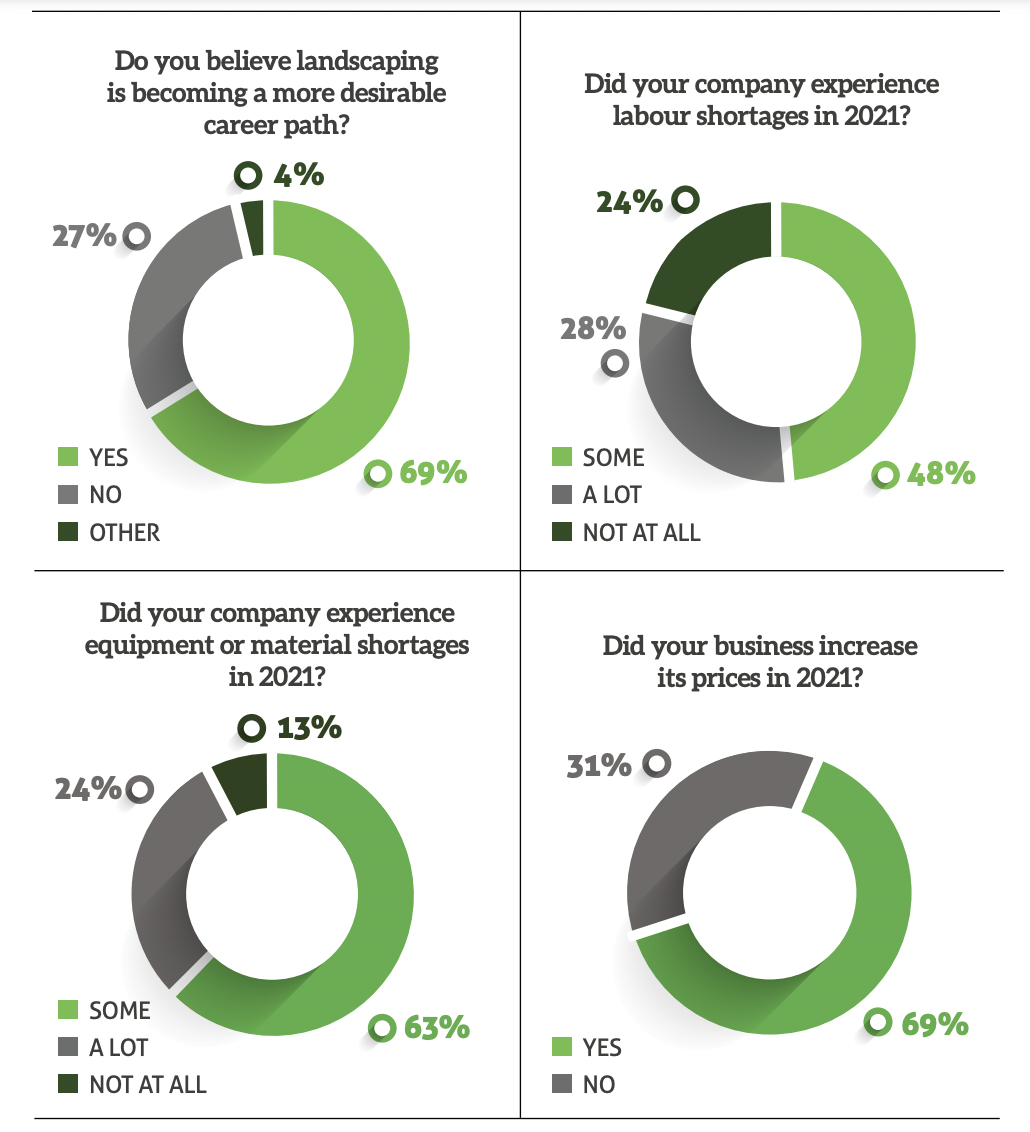

Overall, 75 per cent of survey respondents experienced labour shortages in 2021, while 87 per cent experienced some degree of equipment or material shortages.

As well, 85 per cent of respondents experienced price increases throughout the year, yet only 68.8 per cent increased their own prices.

“(We had) record revenues, but not profits after expenses,” said one survey respondent..

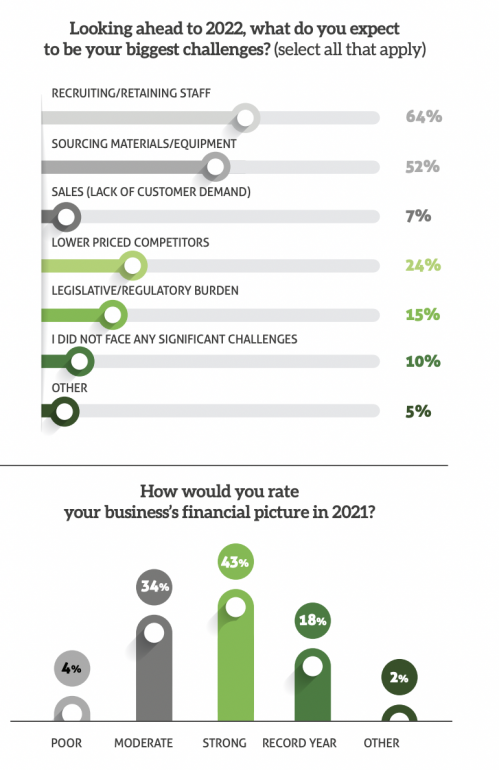

Looking ahead to 2022, the survey found 63.5 per cent of respondents expect recruiting or retaining staff will be one of the biggest hurdles they face, while 51.5 per cent expect sourcing materials or equipment to remain a major issue.

The good news is the industry is recording more business, with 17.5 per cent of respondents noting a record year financially in 2021, and 43 per cent experiencing a strong financial picture for their business.

As well, nearly 70 per cent of respondents believe landscaping is becoming a more desirable career path.

"Normally recruiting and training is an issue. However, we discovered some new team members looking for a change from retail and service industries that have been quite unstable during COVID,” said a survey respondent.

Demand exceeds supply

The increase in business for landscapers is pushing against an already stressed supply chain.

“The demand is greater than it has ever been for anything we sell in this industry,” said Jamie Riddell, SiteOne Landscape Supply’s area manager for Eastern Canada and the I-90 corridor in the United States. “And there is little hesitation to forecast very good growth for the year.”

At Congress Conference, Riddell will join four other industry experts for the Current Supply Chain Issues and Forecast seminar at 1 p.m. on Jan. 19.

“The overriding message I will be conveying is there are uncontrollable impacts on a lot of the things we are doing,“ Riddell said.

The COVID-19 pandemic created swollen consumer demand that outpaced forecasts. Looking at lighting and irrigation products, for example, supply was further hindered by environmental factors. Last year’s hurricane season knocked resin manufacturers offline on the East Coast. Then, an unlikely winter storm in Texas shut down resin producers in the southern United States. A lack of resin meant plastics were not available to manufacture lighting components. The same resin is also used in manufacturing PVC pipe and Polybutylene pipe for irrigation systems.

“Resin availability for manufacturers is dramatically reduced, which is driving the cost of that resin through the stratosphere. Not only is it harder to get, it’s more expensive,” Riddell said. “What we had considered to be an already tight supply chain became an almost impossible supply chain. To this day, there’s still products that are not being manufactured at the same pace as they were pre-winter 2020.”

The answer isn’t abroad

Importing materials is met with its own logistical problems, as a backlog of goods builds up at ports on the West Coast, and container ships must wait several weeks to unload cargo.

In 2020, moving a shipping container from China to California would have cost about $3,000. This year, the price increased to more than $20,000.

Once the container arrives, the freight cost to move it across North America has almost doubled compared to pre-pandemic numbers.

“This is almost the same across every industry and sector group that relies on any supply chain,” Riddell said. “There’s so many things in our industry right now that are making it so hard to be the most prepared. I spend more time today managing difficult supply chain situations, than I do actually facing customers.”

At Best Way Stone in Vaughan, Ont., demand for hardscape products has increased as much as 400 per cent, on average, in the last 18 months.

“We have been able to adjust and find ways to increase our capacity to fill as much of that demand as we could,” said Best Way Stone sales manager Jason Vettese, who joins Riddell on the Congress supply chain panel. “That’s not to say it hasn’t been challenging meeting that demand, and there definitely were and continue to be shortages and longer lead times for products,” Vettese said.

Most hardscape manufacturers have limited their product offering in response to the demand increase.

“I think the pre-cast concrete and hardscape market has fared well, considering all the challenges the industry has faced,” Vettese said. “All factors considered, our industry did a good job being agile and responsive.”

Fortunately for hardscape contractors, the aggregate used in precast products is sourced from a local supply chain. However, some materials, like pigments, additives and packaging, are sourced overseas. As these ingredients are considered highly specialized, Vettese said supply is their biggest challenge as a manufacturer.

“Between delayed freighting and constantly increasing costs, we are faced with a moving target that is very hard to work with when trying to plan and perform effectively for customers,” Vettese said. “We don't see this challenge getting any easier over the next year or two, and we will all have to do our best to continue to be proactive and agile to changes in order to best serve our industry.”

For lumber, restricted supply paired with increased demand continues to elevate prices. However, following consistent price increases in September and October, softwood lumber prices levelled off to meet costs comparable to late 2020, according to Madison’s Lumber Reporter price index.

The price of Western SPF 2x4 #2 reached US$620 mfbm in the first week of November, well below the more than US$1,600 mfbm price tag reached this May. However, the US$620 mfbm price remains about 50 per cent above 2019 costs.

Mike Phillips, executive director of the Ontario Structural Wood Association said a future price forecast is difficult, as the United States and Canadian housing markets, as well as tariffs, continue to elevate pricing while straining supply.

“Exactly what is going to happen in the future is very difficult to predict,” Phillips said. “Even the foreseeable future is hard to predict.”

The solution

Riddell explained he hasn’t noticed any indicators that signal an end to supply chain issues. So, the answer to a successful 2022 season will be to understand business needs well in advance.

“Given enough notice and time to construct orders, we are able to get something to complete the project. In a last minute situation, your options are limited,” Riddell said.

He added two-way communication with suppliers will be key to ensuring materials are available when needed.

“An open, honest conversation — both ways — is what’s going to get the job done the best,” Riddell said. “Communicate early, often and choose partners that are working with you to communicate the good news and the bad news to you.”

Thank you to the 458 readers who responded to the email survey, and congratulations Shades of Summer Landscaping on winning the $250 participation draw prize.