July 14, 2023

Industry feedback provides opportunities for growth and innovation

Landscape Ontario recently undertook an online survey to gain a deeper understanding of the industry’s current operation statistics on various aspects, including: fleet management, equipment usage, training, and marketing.

We appreciate the time our members and some non-members (at least, not members yet!) spent responding to the survey. The data collected will help us to offer the best possible services to our members.

Below are the key findings from the survey. For an analysis of the data, including key findings and conclusions, see the Membership column in this issue.

The survey indicated the majority of companies have annual auto insurance premiums below $10,000, with increases of around 10% over the past few years.

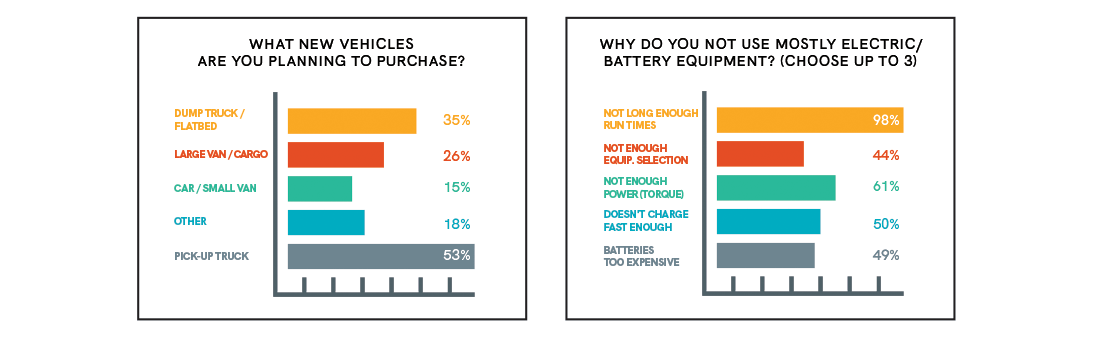

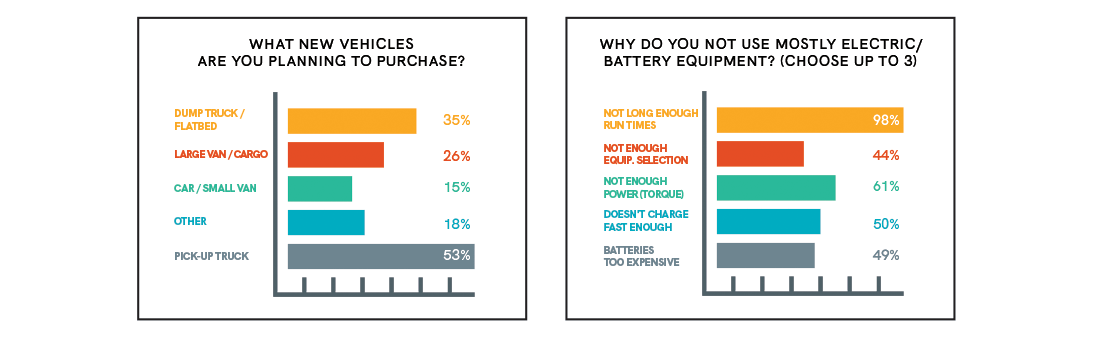

The top reasons for not adopting electric equipment were: insufficient run times, lack of power, and slow charge times.

Among the companies that have made the switch to using primarily electric equipment, (26%) said the key motivations included: reduced emissions, ease of use, and quieter operation.

Most companies (70%) own between one and four computers, with most older than three years. Tablets are widely used on job sites (57%), and 58% of respondents reported incidents of broken devices during projects.

The industry also displayed a consistent need for multiple safety equipment items (72%) and work clothing replacements (74%) per person on a yearly basis — a notable operating/ consumable expense.

We appreciate the time our members and some non-members (at least, not members yet!) spent responding to the survey. The data collected will help us to offer the best possible services to our members.

Below are the key findings from the survey. For an analysis of the data, including key findings and conclusions, see the Membership column in this issue.

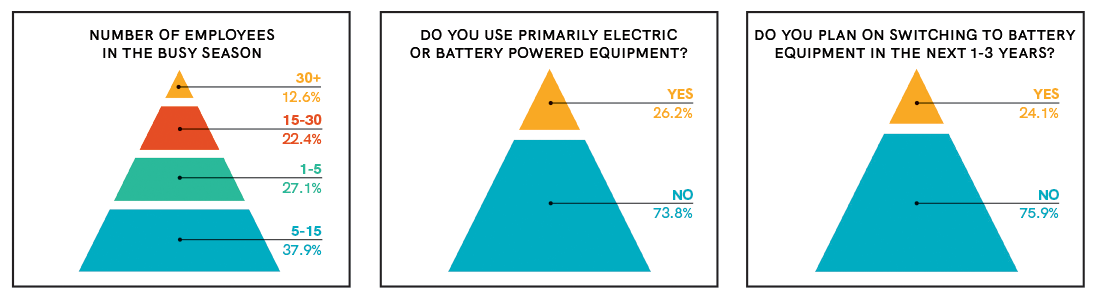

Primary focus and sizes

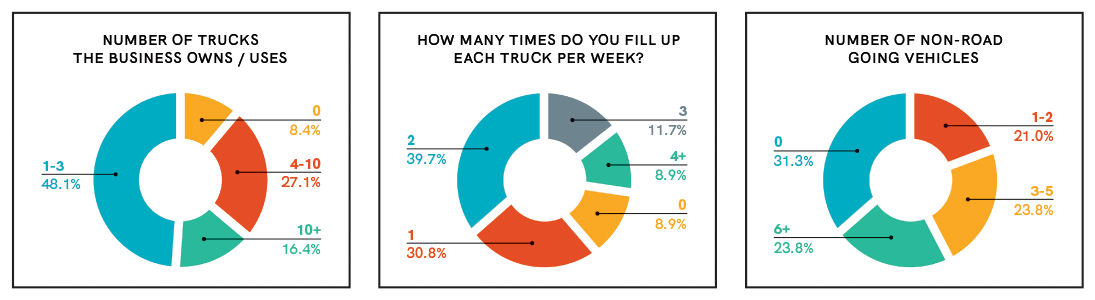

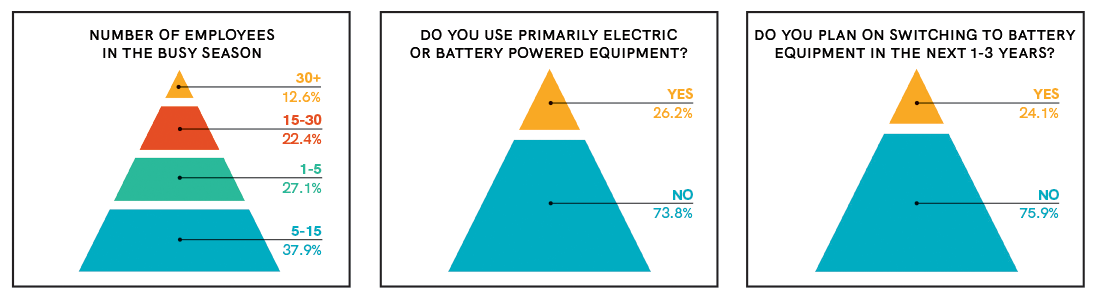

The survey revealed the average company size during the busy season falls within the medium to larger range, employing between five and 15 employees (38% of respondents). The primary focus of the majority of companies was Grounds Management (11%) and general Landscape Contractors (10%). Turf management, snow and ice removal, and irrigation were identified as the least common primary focuses.

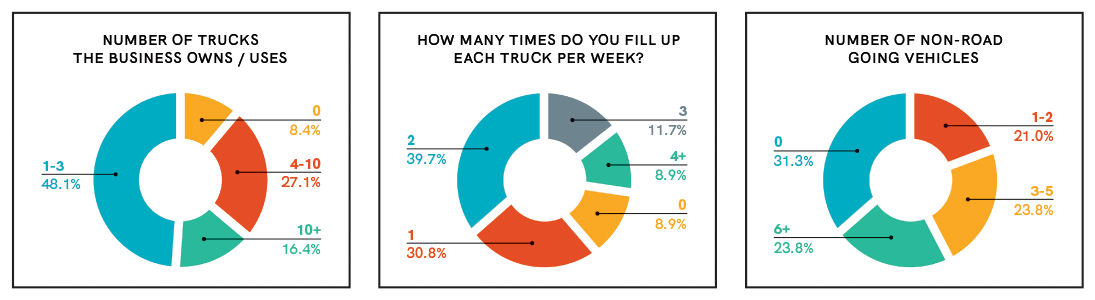

Fleet size and usage

Most companies in the industry said they have an equal number of cars/ vans (smaller vehicles), and trucks — typically ranging from one to three vehicles in each category. Companies tend to refuel trucks twice as often as smaller vehicles, averaging two refills per week, per truck. Additionally, a significant number of companies tend to have either no non-road going/ heavy equipment, or have a substantial fleet of six or more units. A considerable portion of companies expressed interest in purchasing a new truck/vehicle annually, while larger cargo vans are in high demand 26%.The survey indicated the majority of companies have annual auto insurance premiums below $10,000, with increases of around 10% over the past few years.

Equipment types and reasons

Although electric-powered equipment is gaining traction in various industries, most respondents (74%) indicated they have not made the switch to using primarily electric equipment. About the same number (76%) said they are not planning to make the switch within the next three years.The top reasons for not adopting electric equipment were: insufficient run times, lack of power, and slow charge times.

Among the companies that have made the switch to using primarily electric equipment, (26%) said the key motivations included: reduced emissions, ease of use, and quieter operation.

Software and other consumables

The survey shed light on technology adoption and usage within the industry. A significant portion of respondents (62%) reported not using 3D modelling software in their projects, while 67% indicated they do not use drones and 65% have no plans to incorporate them into their operation.Most companies (70%) own between one and four computers, with most older than three years. Tablets are widely used on job sites (57%), and 58% of respondents reported incidents of broken devices during projects.

The industry also displayed a consistent need for multiple safety equipment items (72%) and work clothing replacements (74%) per person on a yearly basis — a notable operating/ consumable expense.